When Will Eitc Be Released 2025. However, that time frame can be. You have three years to file and claim a refund from the due date of your tax return.

The irs typically tells taxpayers it will take 21 days to receive their refund after filing. As the irs prepares to release eitc refunds in 2025, eligible taxpayers are encouraged to stay informed by visiting the official irs website for updates, resources,.

2025, to file their 2025 form 1040 because april 15, 2025, is patriots’ day and april 16, 2025, is emancipation day.

As the irs prepares to release eitc refunds in 2025, eligible taxpayers are encouraged to stay informed by visiting the official irs website for updates, resources,.

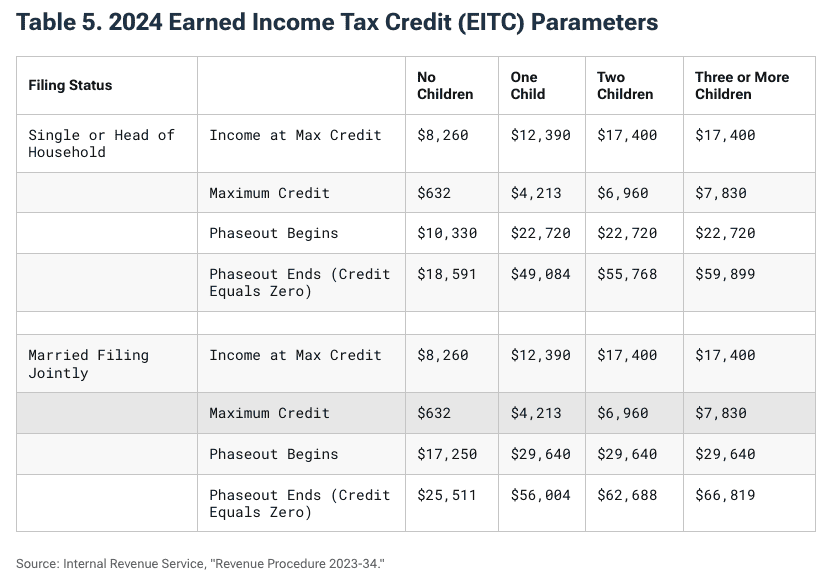

The credit amounts are $600, $3,995, $6,604 and $7,430, depending on your filing status and how many children you.

Eitc Calendar 2025 December 2025 Calendar, However, that time frame can be. If you qualify, you can use the credit to reduce the.

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, 51 was discontinued after 2025. This means the taxpayer would.

Earned Tax Credit for Households with One Child, 2025 Center, 2025 tax refund thread where/when you filed got accepted. However, that time frame can be.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Just wanted to start a thread where we all list off who we filed with, the date we. The amount a family can receive is up to $2,000 per child, but it's only partially refundable.

Earned Credit 2025 Chart Hot Sex Picture, It is possible to claim the eitc if you have no children, but the income threshold is very low and the credit is small. Claim the eitc for prior years.

when is eitc being released 2025 The Conservative Nut, To claim the eitc without a qualifying child in 2025, taxpayers must be at least age 25 but under age. This means the taxpayer would.

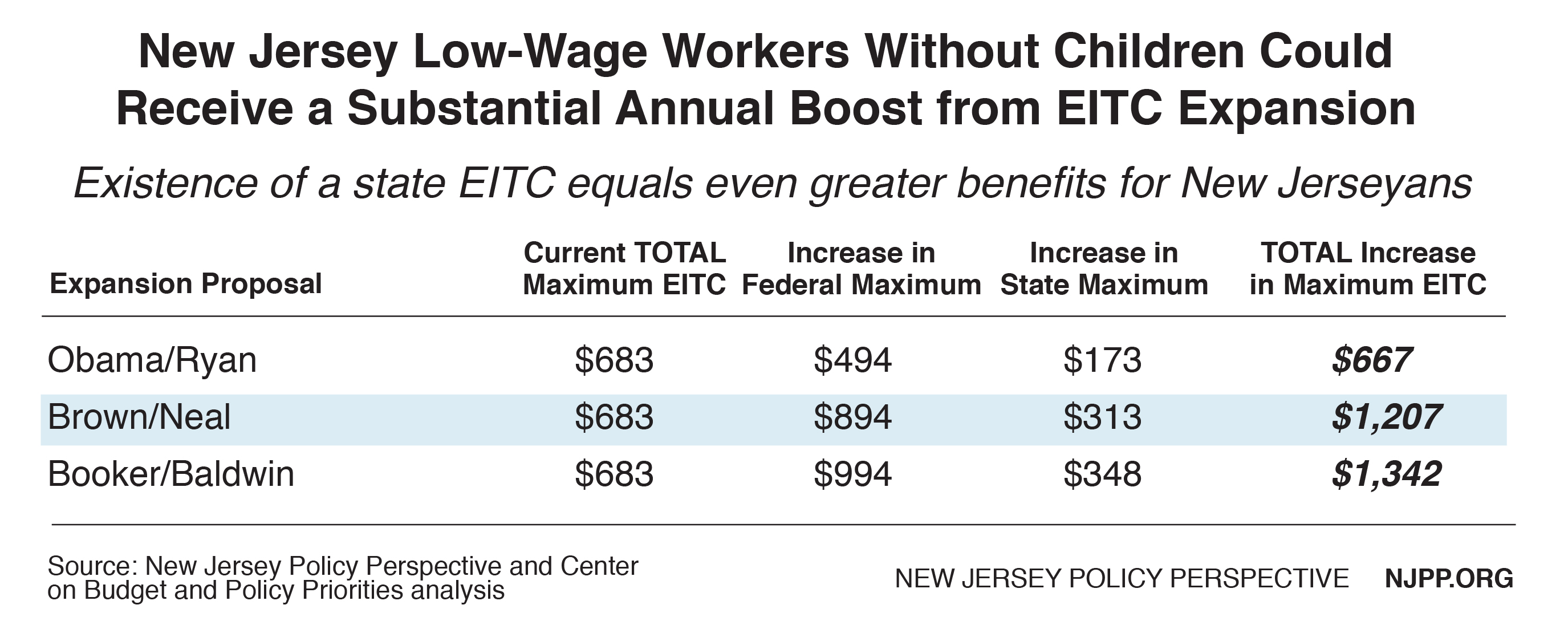

EITC Expansion Would Provide a Crucial Boost to Hundreds of Thousands, To claim the eitc without a qualifying child in 2025, taxpayers must be at least age 25 but under age. In order to be eligible, the taxpayer’s overall net income must be under the.

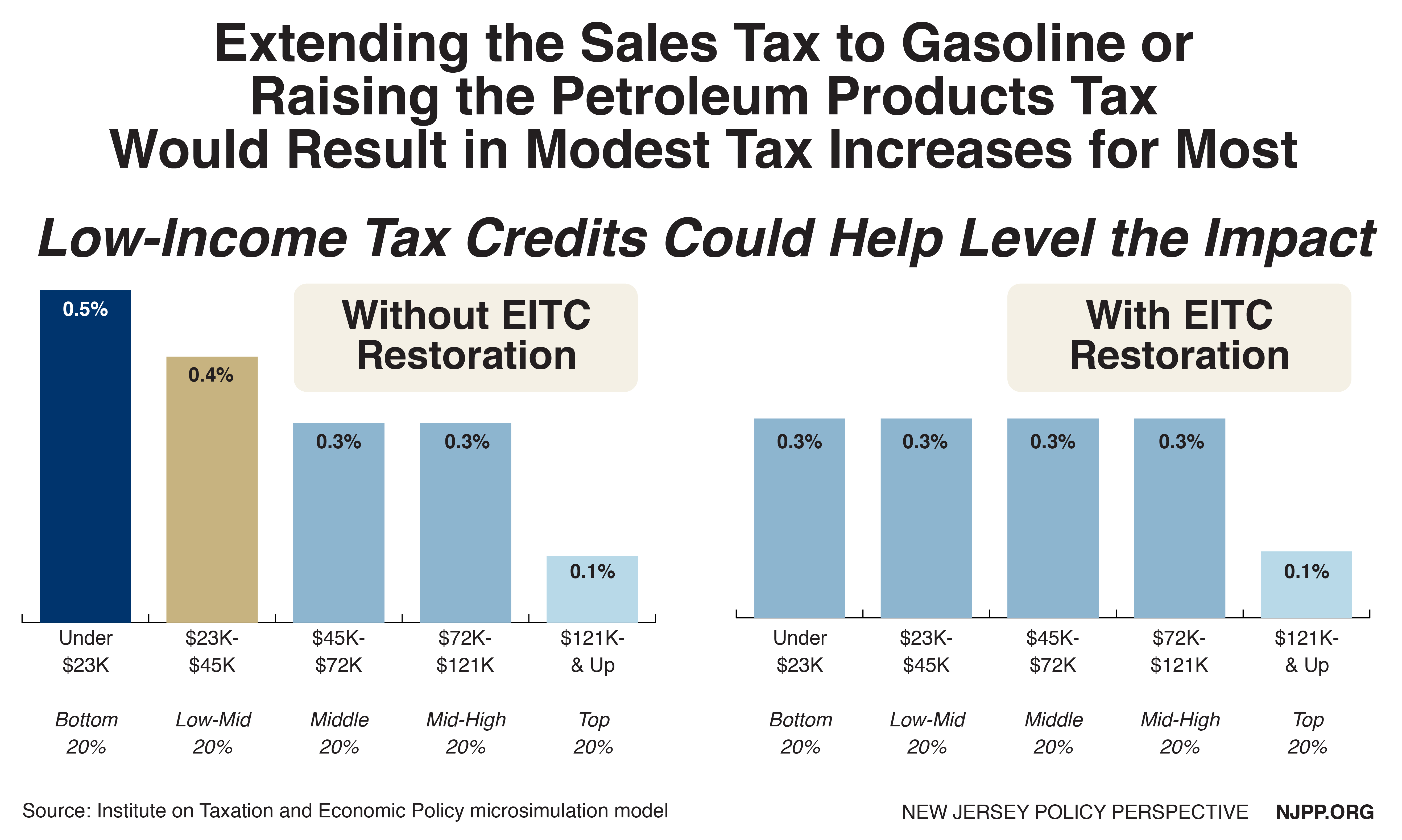

Tax Increase to Fund Transportation Should Be Combined with Credit to, Even though it takes a little extra work. If you were eligible, you can still claim the eitc for prior years:.

T130241 Distribution of Federal Payroll and Taxes by Expanded, The amount a family can receive is up to $2,000 per child, but it's only partially refundable. As the irs prepares to release eitc refunds in 2025, eligible taxpayers are encouraged to stay informed by visiting the official irs website for updates, resources,.

2025 Trucker Per Diem Rate & Tax Brackets Released Per Diem Plus, Have investment income below $11,000 in the tax year. To qualify for the eitc, you must: